Paid Go away, Youngster Care Tax Credit Proposed By Home Democrats : NPR

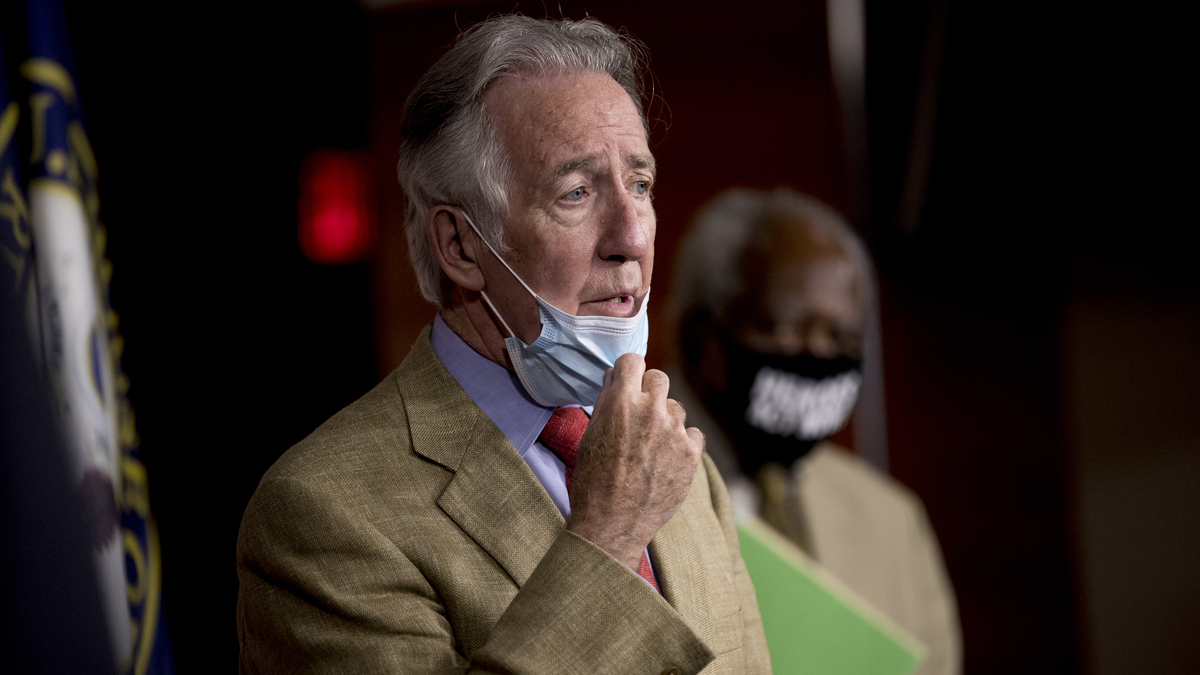

Richard Neal, Chair of the House Ways and Means Committee, D-Mass., Leads Democrats to include childcare and paid leave in upcoming legislation. Andrew Harnik / AP Hide caption

Toggle labeling

Andrew Harnik / AP

Richard Neal, Chair of the House Ways and Means Committee, D-Mass., Leads Democrats to include childcare and paid leave in upcoming legislation.

Andrew Harnik / AP

Congressional Democrats continue to expand the definition of infrastructure with the plan to provide paid vacation and family benefits to the vast majority of Americans.

Democrats explicitly refer to the proposal as “maintenance infrastructure,” adding to a party-wide drive to redefine infrastructure beyond physical projects such as roads, bridges, and waterways. Republicans have opposed this rebranding almost everywhere, but Democrats insist that infrastructure refers to all systems that contribute to a thriving economy.

Richard Neal, chair of the House Ways and Means Committee, D-Mass., Leads the effort with members of the committee responsible for health, social security and taxation.

“Our economy is based on the idea that some workers deserve ‘perks’ like paid vacation or affordable childcare that fits their schedules while the majority are forced to fend for themselves,” Neal said in a statement. “In order for our economy to fully recover from this pandemic, we must finally recognize that workers have families and that the responsibility for caring for them is real.”

The framework unveiled on Tuesday outlines the policy objectives without specifying how much the proposals would cost or how Democrats would pay for them.

The main elements of the plan include 12 weeks of paid family and sick leave for all employees, credits to employers to increase wages for childcare workers, and permanent extensions to existing tax credits.

The expansive proposal is likely to find significant support from the Democrats, but this does not guarantee success for laws that could be both costly and difficult to implement. Democrats hold a slim majority in both houses, and Republicans are unlikely to support the plan.

Neal’s move comes the day before President Biden’s first joint address to Congress on Wednesday night, when he will discuss an aspect of his American family plan that proposes billions in new spending on childcare, education and paid vacation. Democrats are rushing to advocate individual elements of Biden’s plan.

The Democrats still disagree on how to deal with any kind of infrastructure legislation. Some are pushing for Biden to work with Republicans on a smaller, more focused plan that could be backed by both parties. That would allow the Democrats to pursue partisan elements separately.

Such a strategy could allow Democrats to use the budget process to circumvent the threat of a filibuster in the Senate. The rules for budget voting allow the majority party to pass certain tax and spending policies by simple majority. Democrats control 50 votes in the upper chamber and could pass the legislation without a Republican, provided they have unanimous support within their own party.

Such a move is risky, however, as many of the more progressive policies contained in an expanded definition of infrastructure may not find support among more moderate Democrats.

It is unclear how this legislation will be received by moderates like Sens. Joe Manchin (DW.Va.) and Kyrsten Sinema (D-Ariz.), Whose support will be crucial for the passage of laws, especially partisan laws, in the Senate could.

The paid vacation portion of the plan would provide partial wage replacement during the 12 week vacation period. Democrats estimate that most workers would receive around two-thirds of their wages while on vacation, although lower-income workers could receive higher wage compensation. Under the framework, the program will be implemented by the Treasury Department in partnership with existing government programs for paid leave and by employers who are already providing benefits.

Childcare elements of the plan include a refundable tax credit of up to $ 5,000 per year for eligible childcare workers who increase wages.

Democrats are also proposing to make several programs permanent, contained in the US $ 1.9 trillion bill, which was incorporated into law in March. These programs include an expanded child tax credit of up to $ 3,600 per year, paid monthly. a refundable tax credit of up to $ 8,000 for maintenance expenses; and a broader tax credit for low-income workers.

The plan also provides a network to keep workers informed of all the benefits available to them to ensure that more people are using the programs.

Comments are closed.